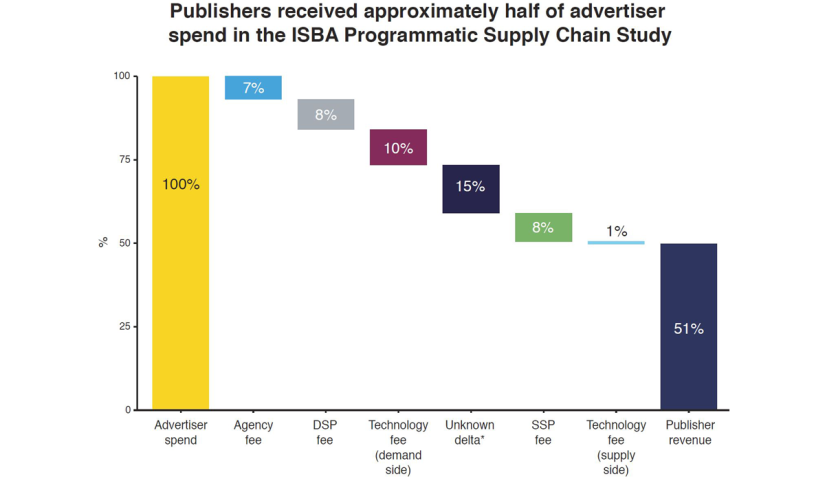

It’s no secret that advertising in the programmatic marketplace comes with a plethora of fees. In some instances, the transactions may be transparent. In other instances, transaction and their fees may be opaque, or even conducted in the hidden veils of a black box. In addition to opaque transactions, the a significant proportion of the advertising dollar never reaches the publisher at all. The graphic below is provided by the ISBA (Incorporated Society of British Advertisers), when they conducted a study on transparency on the programmatic supply chain, and how much of the advertising dollar actually reaches the publisher.

According to the study, a staggering 49% of the advertising dollar never reaches the hands of the publishers. This means that for every dollar spent, the publisher only receives 51 cents.

Agency Fee

A few different methods for agency fee calculations are below. The agency is meant to consult and conduct advertising on the advertiser’s behalf, which is what the fee is charged for.

● Fixed fee for all services rendered

● Fixed fee for programmatic

● Commission

● Agency and adtech aggregated fee

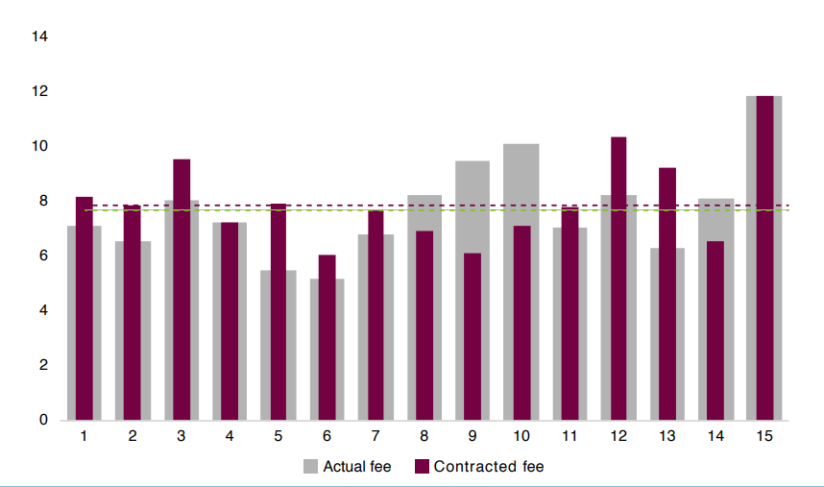

DSP Fee

Advertisers/Agencies utilize DSPs buying engines in order to buy programmatic media in real time. In the study with ISBA, the actual fee averaged to around 8%. Note that the actual fees and contracted fees sometimes varied. This could be due to make-goods or estimated fees, depending on the contract.

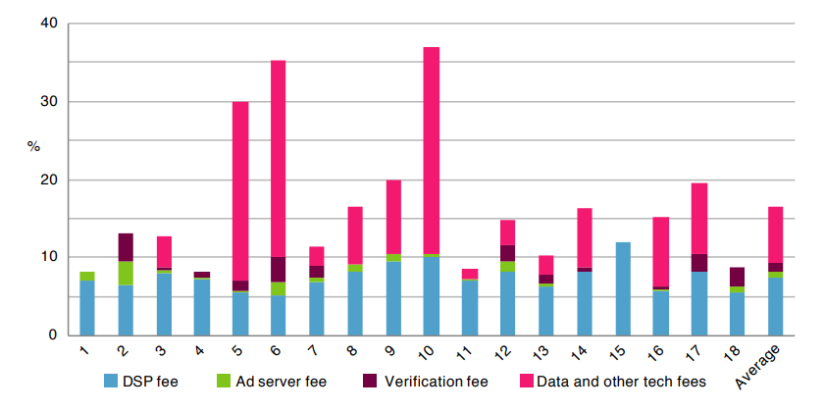

Tech Fees

Tech Fees are mostly demand side. In the ISBA study, this resulted in about 10% of advertiser spend.

- Ad Server Fee: Fee to utilize an ad server (generally Google Campaign Manager) in order to serve ads.

- Verification Fee: Verification of ad serving and viewability, etc. Vendors in this space include DoubleVerify, WhiteOps, MOAT, Integral Ad Science

- Data and Other Tech Fees: Fee to serve data on top of media in order to achieve a targeted message and a higher likelihood of conversion. Vendors in this space include LiveRamp, Oracle, Factual, etc.

- Exchange Bidding Fee (EB): Google charges a fee for usage of its exchange bidding product, Google’s answer to header bidding.

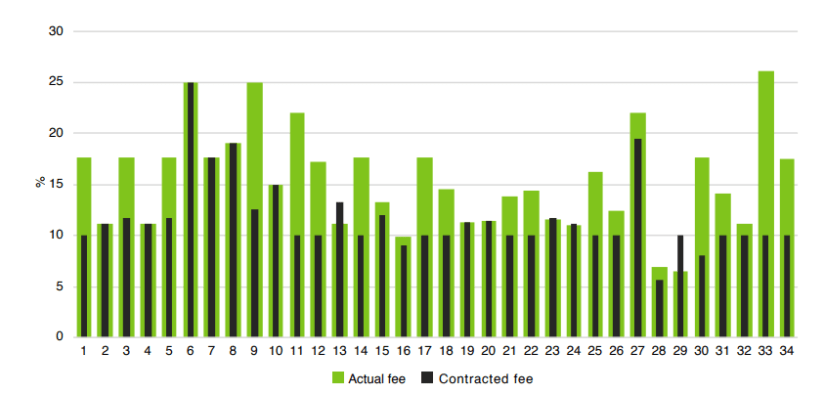

SSP Fee

In the ISBA study, we see that the SSP fee was at around 14% of publisher revenue. Similar to the DSP fee, the actual fee and the contracted fee differed slightly due possible reconcilliations.

Unknown Delta

According to the study, a staggering 15% of the advertising dollar is unable to be accounted for. According to the ISBA study, the DSP spend was on average 15% higher than what the SSP recorded as gross revenue. What’s more, even in a “disclosed” model, as much as 33% of the supply-chain costs can still remain undisclosed.

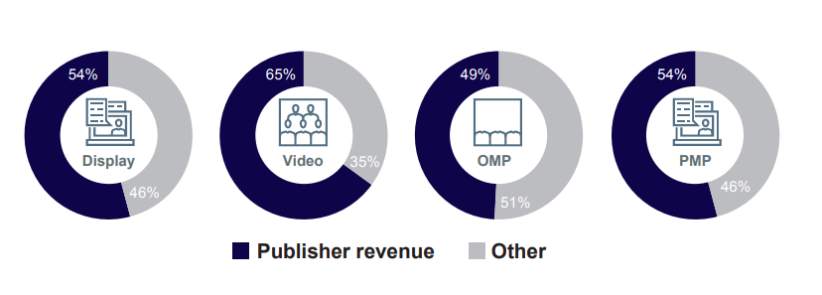

Advertising Spend Breakdown by Media Type and Marketplace Type

In the graphs below, we can see that publisher revenue is least affected in video, but most affected in the Open Marketplace (OMP).

Current Challenges

- Lack of formal structure on how different parties share data and where permission needs to be granted. For example, an SSP may need permission from all 3 of the advertiser, agency, and DSP in order to receive campaign data, whereas another SSP may only need permission from the DSP.

- Complex Supply Chain. Advertisers may have tens and even hundreds of different supply chains just to reach a few distinct publishers. This could result in bid duplication, and definitely introduces complexity when trying to analyze the results of advertiser campaigns.

- Delays in providing access to information.

- In-congruent data structure and naming between platforms. For example, in Google Ad Manager the metric “Product” refers to video, display, Mobile-in-app, etc. In other platforms, this “Product” dimension could be named “Media Type” or something else, causing problems with data consolidation between platforms.

Possible Solutions for the Future

- Full Transparency throughout the Supply Chain: Some partners may want to protect their data, but a strong and structured transparency format of the supply chain needs to be put in place so that players in the ad industry know exactly where the advertising dollar is going. For “disclosed” transaction models, 100% transparency should be enforced, otherwise it isn’t truly disclosed or transparent.

- Cleaner Supply Path: Buyers should double down on investigated their own supply paths, removing partners that may not hold any value. At some point, the infrastructure costs and cannibalization costs of seeing just a little more inventory offset the benefits.

- Format Structure for Report Consolidation: The unknown delta of 15% in the ISBA report is staggering. Advertisers need to know exactly where their advertising dollars are going, and not see it disappear inside a black box. DSPs and SSPs need to figure out where exactly that 15% revenue discrepancy is coming from. Ideally, discrepancy checks should be conducted before vendors conduct business in order to avoid issues such as these.

Sources

- https://www.isba.org.uk/media/2424/executive-summary-programmatic-supply-chain-transparency-study.pdf

- https://digiday.com/sponsored/appnexus-appnexussbl-supply-chain-transparency-vital-programmatic-success/

- https://www.marketingweek.com/programmatic-advertising-supply-chain-brands/

Before anything else, preparation is the key to success.

— Alexander Graham Bell